After the documentary, Sallie Mae Not, premiered at the Whistleblower Summit + Film Festival on July 26, 2021 and garnered the Audience Choice Award, this launched the proposed 6-part docu-series.

Scared to Debt is now in post-production and seeks finishing funds.

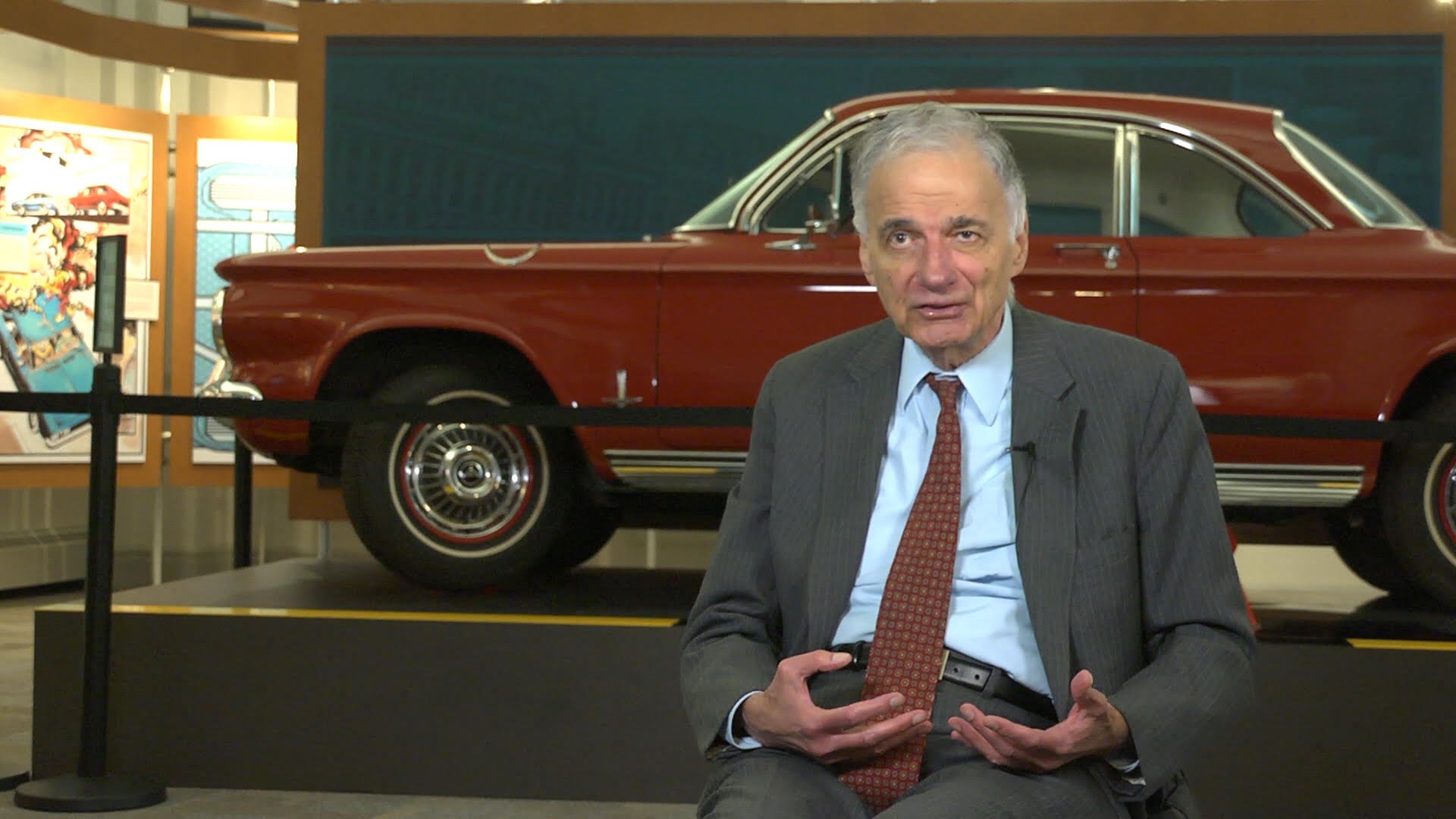

Sallie Mae Not enjoyed unprecedented access to education, media and financial industry figures who appear in the film such as Jon Oberg, former Board of Education analyst turned whistleblower; Matt Taibbi, contributing editor of Rolling Stone magazine; Ralph Nader, political activist and author; Catherine A. Fitts, former Sallie Mae board member and Wall Street financial analyst; Tom Borgers, Wall Street Banker; and Bob Hildreth formerly of the International Monetary Fund. Other figures include conservative Scalia Law School Professor, Frank Buckley (author and speech writer for President Trump) along with U.S. Senators Elizabeth Warren and Charles Schumer. Most importantly, you’ll meet borrowers from all ages, races and socioeconomic backgrounds with drastic stories of student loan debt.

Whether on the right, left or center, the prevailing question remains: Why is the cost of college so damn high?Most students and parents have no idea what they are signing when applying for a student loan, yet many books like Alan Collinge’s The Student Loan Scam (Beacon Press), Elizabeth Shermer’s Indentured Students (Harvard University Press) others offer clues.

The depth of the problem requires an extended series and with your help, we can complete Season One. Here’s what’s in the works …. —Mike Camoin, filmmaker

EPISODES

E1: INDENTURED STUDENTS

A number of scholars including Elizabeth Shermer, PhD, author of INDENTURED STUDENTS: How Government Guaranteed Loans Left Generations Drowning in Debt, help unravel why the cost of college has risen so dramatically in the 21st Century. It’s actually decades in the making. Viewers discover how a privatized lending system derail a once public good. Consumer protections mysteriously disappear from student loans in 1998, permitting Congress and college presidents to raise the cost of tuition well passed the rate of inflation. Education, once the pathway to moving up the economic ladder, becomes a direct burden to millions of Americans — with only the guarantee going to the banks. This debt transfers to family members, impacting women and people of color disproportionately, leaving three generations drowning in debt. The debt ball grows to $1.8 Trillion, what some call a uniquely “American catastrophe.”

E2: THE WHISTLE BLOWER

In 2003, higher ed researcher and policy analyst, Jon Oberg, discovers over billing by loan servicers (Naviant, PHEAA, and others) and reports these transgression to his superiors. Unfortunately, the Department of Education Secretary Spellings, along with the Inspector General at the time, fail to stop the wrong doing, Aware of his personal obligations, Oberg adheres to his duty to taxpayers and an oath to the US. Constitution, and begins to leak data to media like the NY Times. In 2007, the public learns of the whistleblower, Jon Oberg, as he begins to mount personal lawsuits on behalf of the United States. Oberg’s wins 7 out of 9 lawsuits recovering millions back to the Federal Treasury. Oberg wins a Supreme Court decision which sets precedent in multiple class-action lawsuits unfolding today.

E3: Wall Street Greed

The 2009, the Occupy Movement inhabits Zuccoti Park where a host of protesters gather to challenge the 1% ruling class of Wall Street. Among the activists is Alan Collinge, who has just published a book The Student Loan Scam (Beacon Press). Alan’s argument is in fighting for the return of bankruptcy protections. Joining him is former Sallie Mae board member, Catherine A. Fitts, a Wall Street financial expert who reveals what happened when the student loan lending system privatized, acquired collection and real estate companies and knowingly designed a system to fail. Matt Taibbi of contributing editor of Rolling Stone Magazine puts in layman’s terms just callous the privatized lending regime has become, “They don’t care if you have cancer … it’s like Goodfellas, ‘fuck you pay me!’”

E4: College as Parent Plus Traps

Parent Plus loans were designed to dig for deeper pockets to sustain the “public good.” Tom Borgers, who led investigations of Bernie Madoff and the 2008 mortgage lending crisis on behalf of the Federal Government, is a Wall Street banker, fraud specialist, with a brain and a heart. He’s rattled by the student lending crisis unfolding. His scathing findings reveal how colleges fail to ask borrowers whether they could ever afford tuition. Women and people of color are disproportionately impacted by the shaming debt burden. Cosigners like American singer/songwriter Reggie Harris is entrapped like millions of others. Borgers reminds college presidents of their fiduciary responsibilities: IF they were bankers, university presidents would be locked up, or heading to jail! Unfortunately, colleges are not held accountable (see Episode One: Indentured Students).

E5: Torts, Vets and Suicide

In 1971, the Powell Memo which addressed US Chambers of Commerce targeted college campuses and media outlets across the country. Enemy numero uno was the Harvard educated, consumer advocate, Ralph Nader. Collinge visits with Nader at his American Museum of Tort Law in CT. While college presidents remain silent and universities serve as investment syndicates, the untold impact on student borrowers mount. US veterans face the pressure of scamming debt collections where their loan balance only grows even after making tens of thousands in payments. Thoughts of suicide mount while others flee the U.S. A younger generation sees the writing on the wall. With no way out, borrowers like Mike McGuirk turn to activism and a rouge economy.

E6: Solutions vs SLEXIT

Alan’s 16 year grassroots effort that first broke in Fortune Magazine generates national discussion and a petition signed by over one million people on Change.org to Cancel Student Loans by Executive Order. Broken campaign promises could leave President Joe Biden held responsible for the failed lending system. As Alan prepares to depart DC walking past the MLK Memorial, he leaves viewers with his final thoughts to upend what he refers to as slavery. After seeing the series, the future of student loans is now in the hands of an informed citizenry armed with the truth. A sense of hope, freedom and justice prevails.